NTG Latest News

NTG Reports 96% Revenue Growth in Q2 2024 With $2.44M Profit

Toronto, ON / TNW-Accesswire / July 29, 2024 / NTG Clarity Networks Inc. (TSX.V:NCI, OTC: NYWKD);), announces its second quarter results for the period ended June 30, 2024 (all figures in Canadian Dollars).

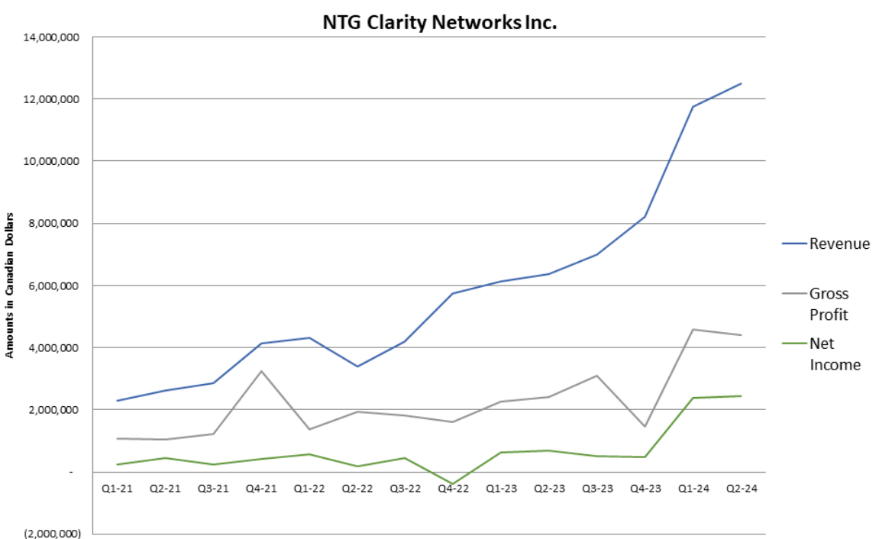

Thanks to the hard work and commitment of our entire team and the confidence of our customers, Q2 2024 has had the highest-ever single quarter revenue at $12.488M, up 96% compared to Q2 2023. This makes the seventh consecutive quarter setting all-time revenue records, while maintaining and increasing profitability with $2.44M in profit for Q2 2024. This is up 250% from Q2 2023 and again is more profit in the quarter than we saw in the entire fiscal year of 2023, while also being an all-time quarterly profit record.

We have a positive working capital of $2,635,848 as of June 30, 2024, compared to a deficit of $2,092,663 on December 31, 2023. With funds from our accelerating growth, we have reduced our long-term debt by a total of $367,618 for the year, including $300,000 towards the outstanding indebtedness held by a numbered Company.

Improvements on our balance sheet have led to a shareholders’ equity of $1,824,101 as of June 30, 2024, compared to a deficit of $3,237,143 at December 31, 2023, marking the first quarter with a positive shareholders’ equity since Q3 2016.

In the first half of 2024, we have consistently had quarterly bottom-line net income margins of around 20%. Due to this consistent exceeding of guidance, we are actively reviewing our targets for 2024 and expect to share updated guidance in the near future.

Income statement highlights for the three and six months ended June 30, 2024 and 2023

|

|

3 Months Ended |

|

6 Months Ended |

||||||

|---|---|---|---|---|---|---|---|---|---|

|

|

June 30, 2024 |

June 30, 2023 |

|

June 30, 2024 |

June 30, 2023 |

||||

|

REVENUE |

$ |

12,488,315 |

$ |

6,373,261 |

|

$ |

24,243,835 |

$ |

12,500,439 |

|

COST OF SALES |

|

8,095,274 |

|

3,947,159 |

|

|

15,265,698 |

|

7,818,259 |

|

GROSS PROFIT |

$ |

4,393,042 |

$ |

2,426,102 |

|

$ |

8,978,137 |

$ |

4,682,180 |

|

Expenses |

|

2,049,776 |

|

1,375,091 |

|

|

4,290,117 |

|

2,518,431 |

|

Foreign exchange loss (gain) |

|

123,731 |

|

(176,066) |

|

|

(189,261) |

|

(200,731) |

|

Net Income from operations |

|

2,466,997 |

|

874,945 |

|

|

4,498,759 |

|

1,963,018 |

|

Other - Exchange (loss) gain on translation |

(23,623) |

|

(176,684) |

|

|

322,482 |

|

(627,012) |

|

|

Net Income after taxes |

$ |

2,443,374 |

$ |

698,261 |

|

$ |

4,821,241 |

$ |

1,336,006 |

|

|

|

|

|

|

|

|

|

|

|

|

Per Share |

$ |

0.06 |

$ |

0.00 |

|

$ |

0.13 |

$ |

0.01 |

Balance Sheet Highlights for the six months ended June 30, 2024 and December 31, 2023

|

|

June 30, 2024 |

December 31, 2023 |

||

|---|---|---|---|---|

|

Total Assets |

$ |

18,805,235 |

$ |

12,392,158 |

|

Total Liabilities |

$ |

16,981,134 |

$ |

15,629,301 |

|

Deficit |

$ |

(15,970,160) |

$ |

(20,468,919) |

|

Shareholder’s Equity |

$ |

1,824,101 |

$ |

(3,237,143) |

Outlook

Our track record of sustained rapid growth in growing markets has continued with another quarter breaking revenue record, and with Q2 having the highest single-quarter revenue ever.Q2 was the seventh consecutive record-breaking quarter for revenue. Consolidated revenue for Q2 2024 was $12,488,315, up 96% from $6,373,261 for the same period in 2023. The trend in growth carries forward to our net income as well, with Q2 2024 having a net income of $2,443,374, up 250% from $698,261 for the same period in 2023.

With its ambitious Vision 2030 economic development plan, the Kingdom of Saudi Arabia (KSA) is focused on diversifying its economy away from Oil & Gas by investing in digital transformation, AI, infrastructure, tourism, entertainment, and being a hub for financial activities in the region. With decades of experience in the region, we expect the strong demand for our services and products to continue as these sectors rapidly build out technical infrastructure and software and choose NTG as their preferred partner. KSA continues to be the primary contributor to our revenue growth with an increase of 146% over the same period last year.

We also have a team of sales personnel dedicated to our flagship software product, NTGapps, targeting new customers in this currently booming KSA economy. We are targeting small and medium enterprises (SME) across multiple verticals that now include the medical sectors and the food & beverage industry in addition to the telecom and financial sectors. For more information, visit www.ntgapps.com.

In 2021, management began transforming NTG Egypt into a supplier of offshore services for international customers through our Egypt Offshore Centre, scaling back sales activities in Egypt except for supporting NTG Egypt’s legacy customers. This strategy allows us to pay expenses in the devalued Egyptian Pound, while collecting revenue in stronger currencies such as the Saudi Riyal, which is pegged to the US Dollar.

Since embracing this offshore model, we have been able to connect more clients with talented candidates faster, accelerating their digital transformation journeys, all the while at a lower cost to them and providing consistent margins for NTG. This is NTG’s strategy; to hedge the devaluation of the Egyptian Pound while continuing to take advantage of growth in the region.

NTG’s current work on hand (which includes unbilled POs as of June 30, 2024, and new POs/contracts received and previously announced since then) is approximately $26.7 Million, the majority of which is expected to be completed in 2024. Note this does not include some of the announced contracts that we did not receive POs for. This, along with our $24.2 Million in booked revenue in 2024 YTD puts NTG in a strong position to meet our $50 Million 2024 revenue target.

In the first half of 2024, we have consistently had quarterly bottom-line net income margins of around 20%. Due to this consistent exceeding of guidance, we are actively reviewing our targets for 2024 and expect to share updated guidance in the near future.

As we enter the second half of 2024, we continue to grow with a focus on our four-part commitment to:

1. Customers by providing flexible, quality services at a competitive price.

-

We accelerate and simplify the digital transformation journey for our clients by providing the right solution delivered by passionate professionals both on their sites and offshore.

2. People by helping our staff grow and develop personally and professionally.

-

We empower our staff to build and deliver challenging projects while providing opportunities for training and career advancement both internally and outside NTG.

3. Shareholders by continuing our growth trajectory and profitability.

-

With purchase orders on-hand and contracts we expect to close, we project our 2024 revenue to be approximately $50 Million.

-

With three years of consistent profitability under our belt, we are actively identifying opportunities to make sure as much of this new revenue as possible flows to the bottom line.

-

The increase in share price in 2024 has gone from $0.20 in January to $0.93 at the end of June, a 365% increase in 6 months.

4. Community by passing our experience down to the next generation.

-

We provide youth education and employment opportunities tailored to the modern job market through the NTG Academies, School, and on-the-job training.

We look forward to continuing our growth through 2024 and beyond, using our growing funds to create value for our shareholders by investing in growth initiatives and continuing to pay down our longer-standing debts.

In an unrelated matter, the Company announced that share options will be issued for each member of the Company’s Board of Directors; Ashraf Zaghloul and Kristine Lewis will receive 100,000 share options each; Saleem Siddiqi and Zeeshan Hasnain will receive 75,000 share options each. Each option will be exercisable at a price of $0.90 per share and will vest immediately.

About NTG Clarity Networks Inc.

NTG Clarity Networks’ vision is to be a global leader in digital transformation solutions. As a Canadian company established in 1992, NTG Clarity has delivered software, networking, and IT solutions to large enterprises including financial institutions and network service providers. More than 700 IT and network professionals provide design, engineering, implementation, software development and security expertise to the industry’s leading enterprises.

Forward Looking Information

Certain statements in this release, other than statements of historical fact, are forward looking information that involves various risks and uncertainties. Such statements relating to, among other things, the prospects for the company to enhance operating results, are necessarily subject to risks and uncertainties, some of which are significant in scope and nature.

These uncertainties may cause actual results to differ from information contained herein. There can be no assurance that such statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. These and all subsequent written and oral forward-looking statements are based on the estimates and opinions of the management on the dates they are made and expressly qualified in their entirety by this notice. The Company assumes no obligation to update forward looking statements should circumstances or management's estimates or opinions change.

For Further Information:

Adam Zaghloul, Vice President, Strategy & Planning

NTG Clarity Networks Inc.

Ph: 905-305-1325

Fax: 905-752-0469

Email: adam@ntgclarity.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.